The Australian Taxation Office ('ATO') has released the online application form today for employers, sole traders, and eligible business participants (including company directors, trust beneficiaries and partners) to be able to enrol for the JobKeeper program. It is imperative that the enrolment form be completed by 30 April 2020 in order to access Jobkeeper payments for the month of April. Payment is expected to be received by 14 May 2020.

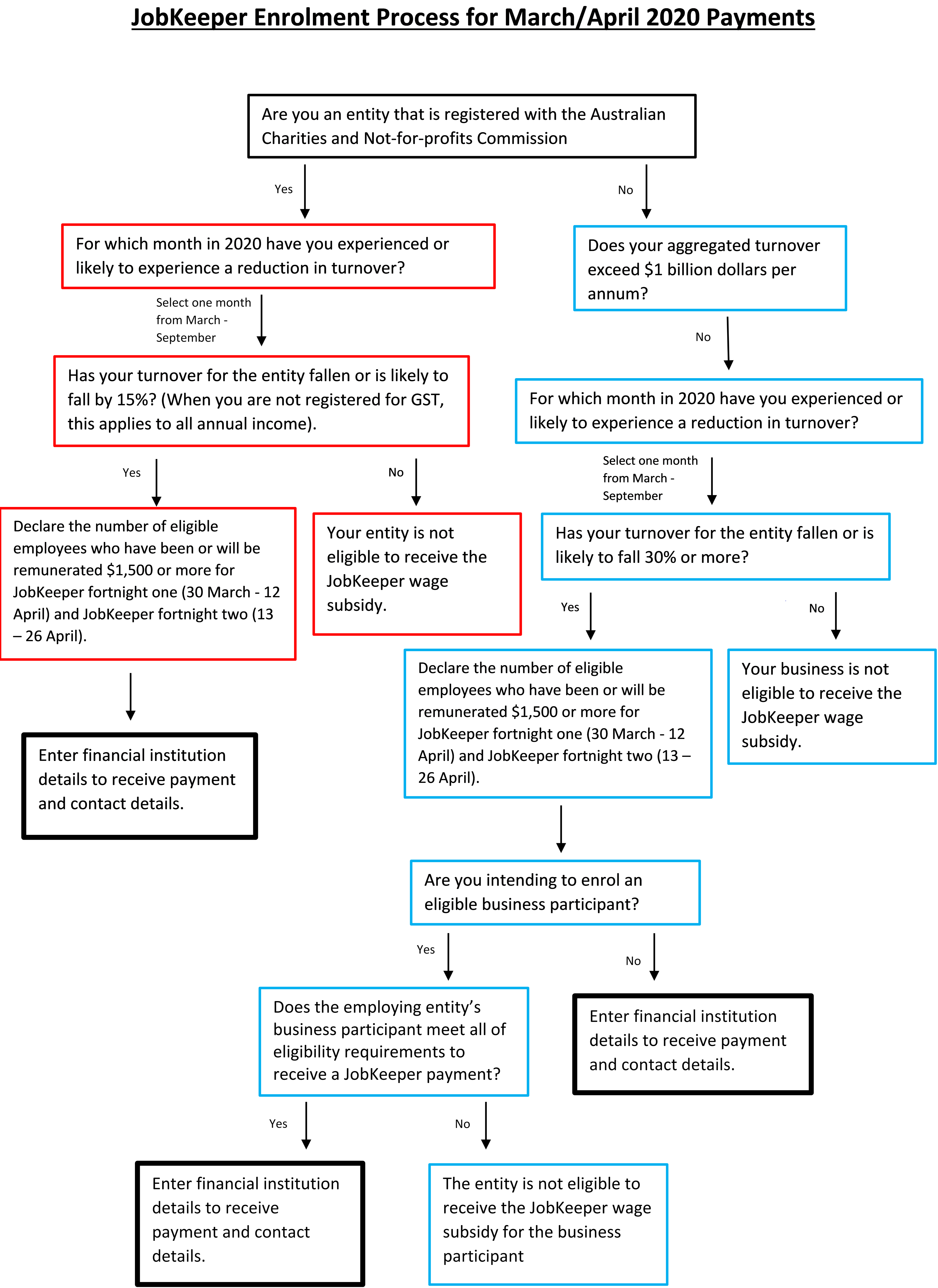

A simplified summary of the enrolment process is shown below:

This enrolment form is available through the Tax Agent Portal and can be completed by us on behalf of clients. Alternatively, an employer can access the enrolment form through their business portal.

Our initial review of the enrolment process has revealed some obvious inconsistencies with the legislation and omissions in the process including:

- Inability to use the June 2020 quarter for the turnover test;

- Entities with an eligible business participant and no employees do not have the option to declare an eligible business participant without also declaring an employee; and

- There is a curious additional sentence the enrolment form for Australian Charities and Not-for-profits that do not appear in the legislation

If these inconsistencies apply to you and they are not rectified by the ATO shortly, we can approach the ATO on your behalf to ensure you gain access to the JobKeeper payments for the month of April.

As a requirement of the JobKeeper payments, it is crucial that each employee has signed the JobKeeper Employee Nomination Notice, and this is kept on record by the employer by 30 April 2020. Similarly, eligible business participants need to complete the JobKeeper Nomination Notice for Eligible Business Participants - excluding sole traders by 30 April 2020.

As the enrolment process has been released today we expect it will evolve over time. We will monitor these changes and provide further information as it comes to hand.

If you require any assistance we recommend getting in touch with your usual Hall Chadwick adviser, or contact