In May 2023, the Australian Taxation Office (ATO) published a new practical compliance guideline in relation to arrangements involving international related party transactions and the development, enhancement, protection and exploitation (DEMPE) of intangible assets.

Intangible assets are trademarks, copyright, designs, know-how, patents, secret formulas or processes, or similar property or rights*. Other types of intangible assets are intellectual property assets including access to customer databases via a license, the license of an algorithm, software licenses, and leases or licenses of other rights over assets.

Practical Compliance Guideline PCG 2023/D2 “Intangible Arrangements” (PCG 2023/D2), provides the ATO views and illustrative examples as what types of events and transactions involving intangible assets may attract future ATO review or audit.

PCG 2023/D2 provides a risk assessment framework which can be considered by multinational businesses and international related party transactions involving intangible arrangements.

Intangible assets described in PCG 2023/D2 that are rated “low risk” are unlikely to result in future ATO

examination or audit. However, intangible arrangements that are rated “high risk” by the ATO are more likely to

attract future ATO review or audit.

* Refer OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations 2017 at Chapter VI: Intangibles paragraph 6.6.

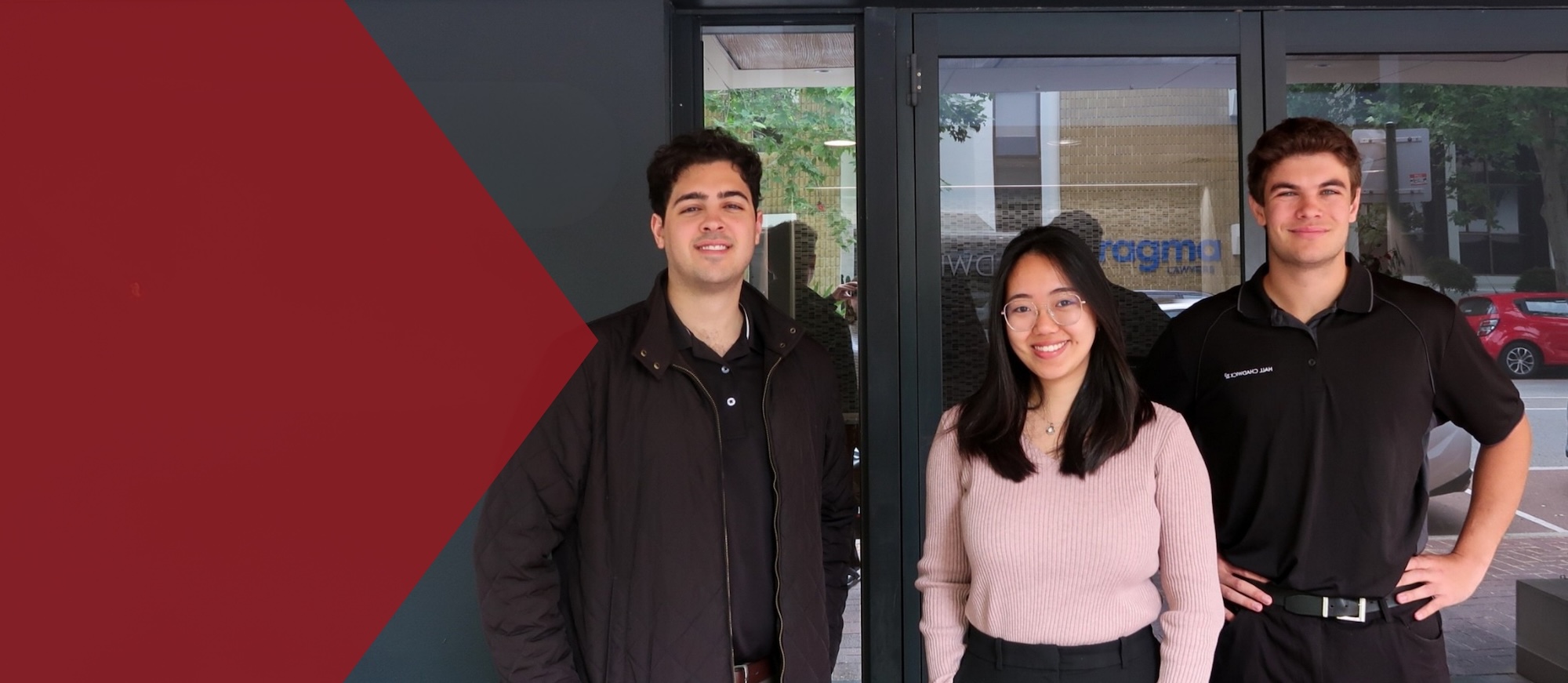

Service Arrangement Involving Intangible Assets – Low Risk

The following example of intangible arrangements, contained in PCG 2023/D2, provides Australian head-quartered businesses where intangibles are held in Australia, have a low risk to future ATO review or audit.

Overview of Arrangement

Diagram 19: Example 13

“AusCo is an Australian-headquartered company with subsidiaries in offshore locations, ForCo 1 and ForCo 2.

AusCo’s founder, an Australian tax resident, developed a software product that has been commercialised and distributed globally. AusCo employs 15 staff, ForCo 1 employs 3 staff and ForCo 2 employs 2 staff.

AusCo owns the intangible assets associated with the software product and under the direction of the founder, AusCo manages, performs and controls all of the related DEMPE activities and assumes associated risks. Worldwide income from the distribution of the software products is derived by AusCo.

ForCo 1 and ForCo 2 provide support activities to assist AusCo. ForCo 1 and ForCo 2 receive cost-based remuneration from AusCo under Service Agreements. AusCo maintains evidence substantiating the arm’s length nature of the pricing and terms of each of the Service Agreements.

The arrangements between AusCo and its subsidiaries would be regarded as a low risk Intangibles Arrangement.”

It is worth noting, arrangements involving Australian businesses and offshore international related party transactions, have differing levels of compliance risk and depend on the nature of the development, enhancement, protection and exploitation of intangible assets.

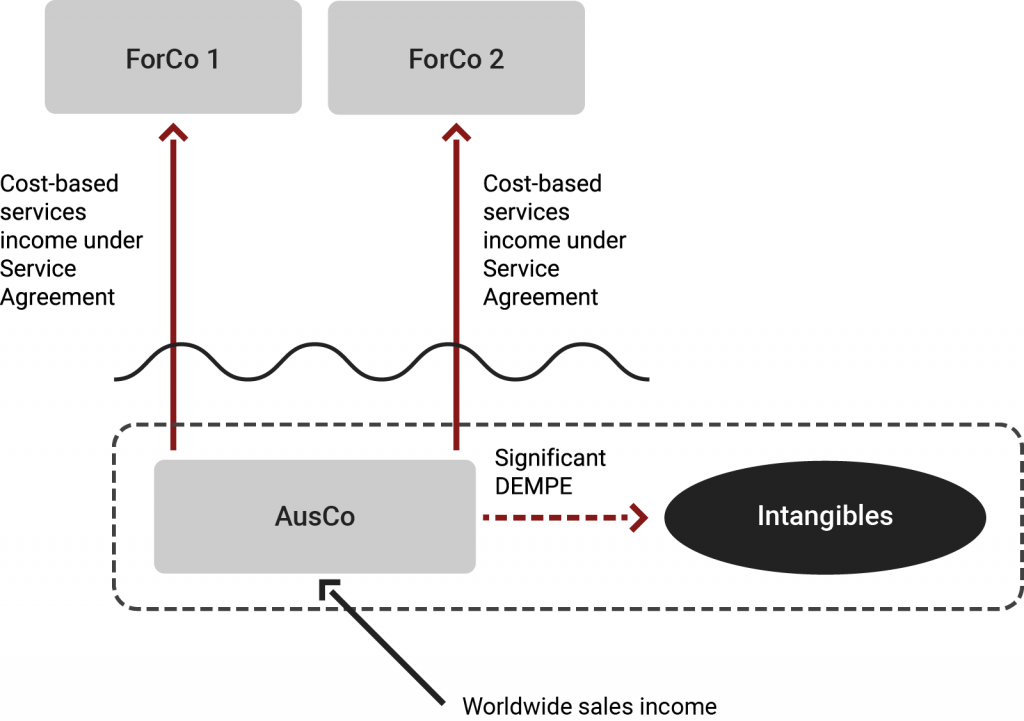

Centralisation of Intangible Assets – High Risk

From the ATO’s perspective, PCG 2023/D2 provides the following example of an intangible arrangement at high risk of future ATO review or audit.

Overview of New Arrangement

Diagram 3: Example 1

The example above, demonstrates the licencing of existing intellectual property to a new foreign company for an arm’s length royalty, with the Australian entity continuing to perform R&D activities under a service agreement, and the new foreign company slowly building out staff and resources to undertake more of the R&D activity.

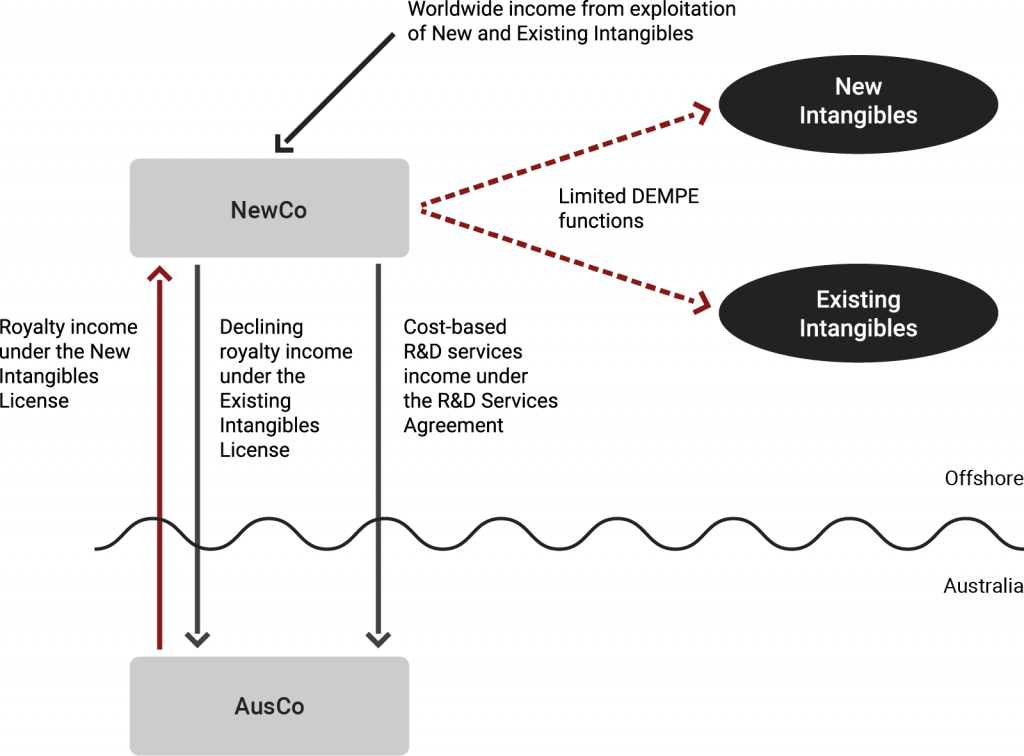

Migration of Pre-Commercialised Intangible Assets – High Risk

The diagram below provides another example of an intangible arrangement at high risk of future ATO review or audit.

Overview of Arrangement

Diagram 8: Example 5

The example above demonstrates an Australian company that has started developing software but is in pre-commercial stage. It moves the intangible assets to a new company in a foreign jurisdiction that becomes the global headquarters and is where the founder travels to further develop that software. The subsequent commercialisation of the software occurs from the foreign company, with services provided to it by the Australian company under a services agreement.

Conclusion

The ATO compliance risk that may apply to a particular business use of intangible assets will be determined based on the facts and circumstances of the particular commercialisation of the use of intangible assets by an Australian business.

Importantly, a business should document the use and operation of intangible assets in their business with evidence that is appropriate based on the complexity of the taxpayer’s business and the extent to which intangible assets contribute to the business.

Multinational businesses with intangible arrangements should consider existing arrangements in accordance with the risk framework in PCG 2023/D2 and given possible future ATO compliance activity.