Are you looking to establish a business structure overseas?

A common vehicle for investment into the United States and United Kingdom is a limited liability company (“LLC”) or a limited liability partnership (“LLP”).

An LLC combines the flexibility of a partnership with the asset protection benefits of a company. An LLC is an entity separate from its owners, and importantly, the liability of the owners is limited.

Generally, an LLC is not subject to tax in the overseas jurisdiction. Rather, it is a “pass-through” entity, meaning the members are taxed on the LLC’s profits in their individual tax returns. Unlike a traditional partnership, an LLC only requires one member.

Another popular investment vehicle is an LLP. Like an LLC, an LLP is generally not subject to tax as it is a “pass-through” entity. The key benefit of an LLP over a traditional partnership is that limited partners are only liable for their own actions and are protected from the negligence of other partners.

At times, the treatment of certain business structures for tax purposes across borders is not aligned. In the absence of the foreign hybrid rules, certain entities which are treated as partnerships for tax purposes overseas, are treated as companies for tax purposes in Australia resulting in adverse tax consequences for investors.

Prior to the introduction of the foreign hybrid rules, taxpayers with certain business structures overseas were subject to the controlled foreign company (“CFC”) or the foreign investment fund (“FIF”) provisions, leading to unfavourable tax outcomes and significant compliance costs.

The foreign hybrid rules can overcome this mismatch and are highly attractive to Australian investors.

The Foreign Hybrid Rules

The foreign hybrid rules are found in Division 830 of the Income Tax Assessment Act 1997 (“ITAA 1997”) and aim to align the treatment of certain entities for tax purposes across borders.

Foreign hybrid is defined in Section 830-5 of ITAA 1997 to mean a foreign hybrid limited partnership or foreign hybrid company (“Foreign Hybrid”). Where an entity satisfies the definition of a Foreign Hybrid, Division 830 will come into effect to treat the entity as a partnership for tax purposes in Australia. Generally, this means foreign tax paid can be utilised to offset Australian tax liabilities, thereby avoiding double taxation. Furthermore, foreign tax losses can reduce Australian taxable income, subject to a limit described below.

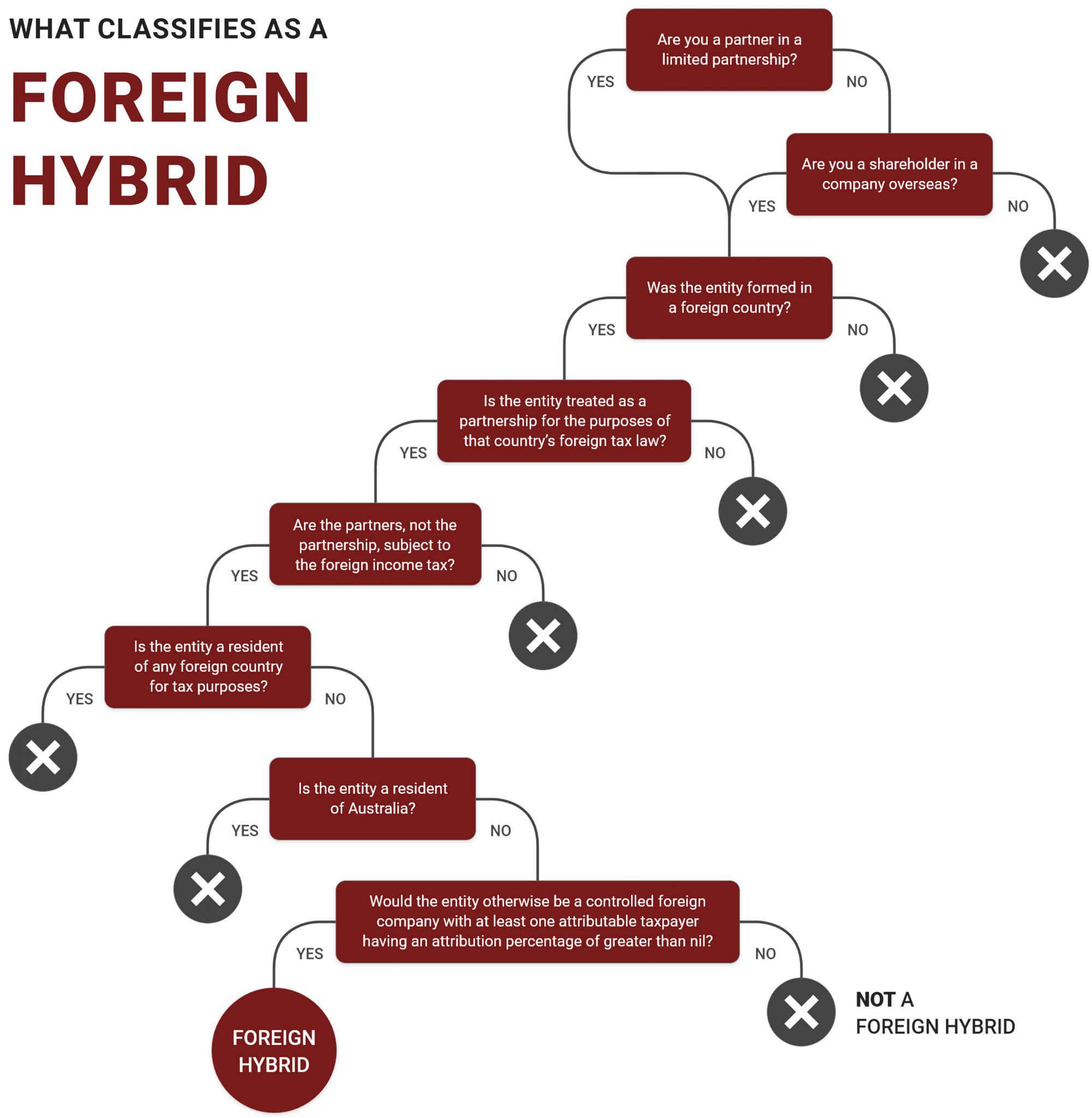

The flowchart below may assist you in determining whether an entity is a Foreign Hybrid:

Other Consequences of the Foreign Hybrid Rules

The foreign hybrid rules apply special rules to Foreign Hybrids in addition to those that normally apply to partnerships. Division 830 contains certain provisions which impact a partner’s ability to utilise losses and the cost base of partnership’s assets for tax purposes.

Loss Limitation Rules

The losses which may be used by the partners to offset income from sources other than the Foreign Hybrid are limited by the foreign hybrid rules. The limit is based on the particular partner’s contributions to the Foreign Hybrid. Each year, an adjustment is made to take into account any additional contributions or withdrawals.

Capital Gains Tax

The partners will have a proportional interest in the assets of the Foreign Hybrid and may also have a residual CGT asset because of their interest in the Foreign Hybrid.

Want to know more?

If you are a member of a foreign entity or you are looking to establish a structure overseas, please do not hesitate to reach out to your trusted Hall Chadwick advisor to find out more about the Foreign Hybrid rules.