Receipt Bank helps create 'effortless bookkeeping' by extracting key information from your receipts and invoices, removing the need for manual data entry. Receipt Bank then publishes the data to your accounting software.

Features:

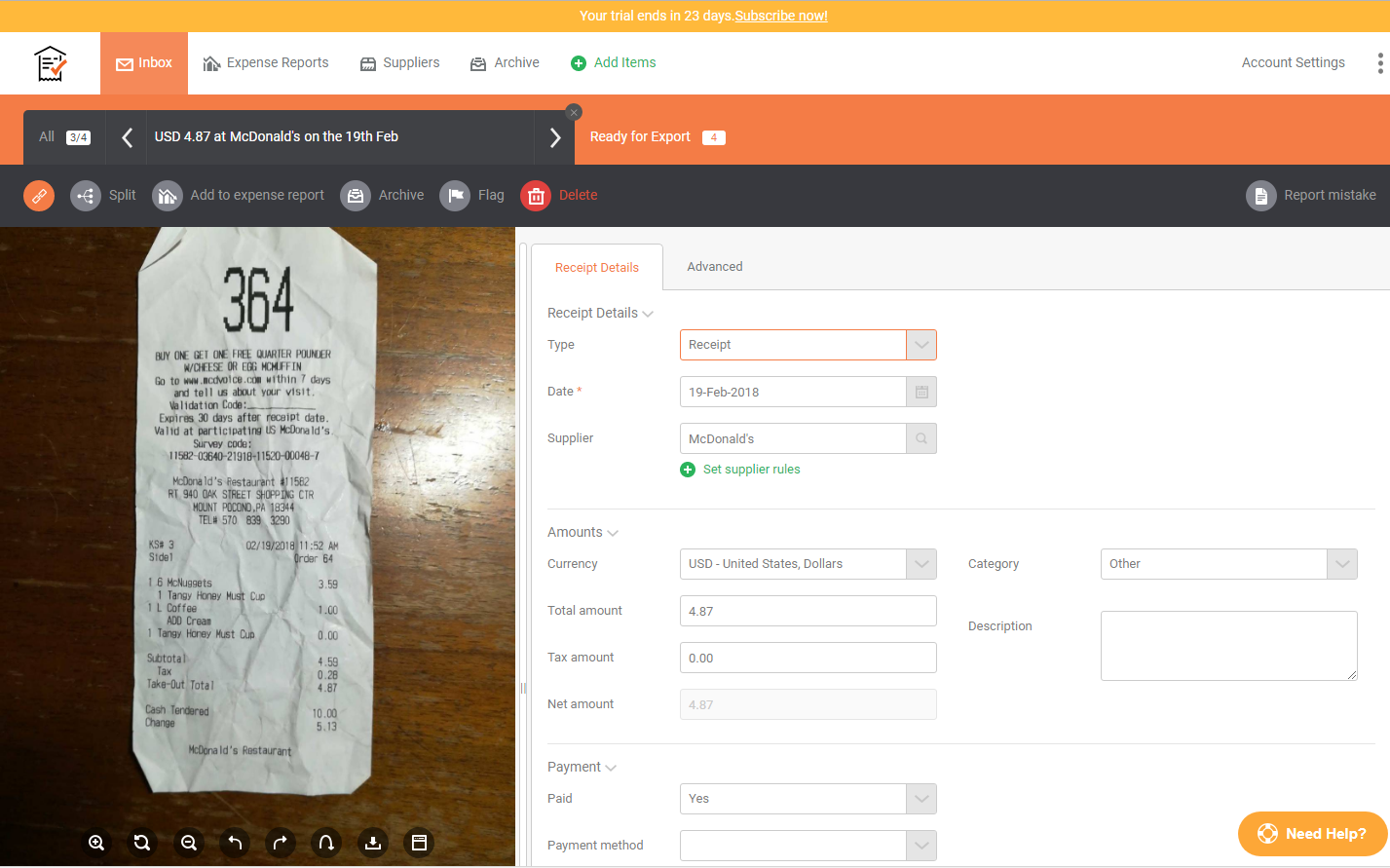

- Reduced data entry - The software automatically extracts the relevant data (i.e. supplier name, invoice #, amounts, GST) from the document and sends it directly to your accounting system.

- No more paper and filing - The invoices/receipts are saved into Receipt Bank and your accounting system, helping your business become paperless.

- Upload methods - Via mobile app, email (get your suppliers to email Receipt Bank directly) or their website.

- Multiple users - Receipt Bank can be used by multiple users where there are more than one person incurring expenses.

- Expense claims - Receipt Bank can be used for recording and managing expense claims for your staff.

- Document fetch - This feature pulls documents (i.e. Tax invoices) from popular suppliers directly.

- Accounting system integration - Receipt Bank integrates seamlessly with a number of accounting systems including; Xero, QuickBooks Online, MYOB and Sage.

[caption id="attachment_3133" align="alignnone" width="1024"]

The above image shows the detail of what can be extracted from a receipt, even if it isn't in

perfect condition[/caption]

Why You Should Be Implementing Receipt Bank Now

Given the increase in businesses working remotely and from home, there's no better time to implement Receipt Bank as your team can upload invoices/receipts and other documentation remotely ready for you or your bookkeeper to get your accounts in order.

In addition, with increasing financial pressure on businesses, the need to automate and reduce admin overheads is more important. We've seen Receipt Bank used across a wide range of businesses and industries, resulting in reducing data entry time between 50% to 80%.

Hall Chadwick offer a free Receipt Bank subscription to all our clients, so please get in touch with our Digital Advisory team or your adviser for more information.