Business Masterclass - Fiscal Update

Come and join us for breakfast on Tuesday 28th July as part of the Business Masterclass Series.

This event will f

Latest Insights

The Western Australian Government has announced a range of payroll Tax measures to support businesses impacted by COVID-19.

Payroll Tax Waiver

From Ma

Top 10 Perth accounting and tax firm Hall Chadwick has strengthened its audit and assurance division appointing Michael Hillgrove as a p

Culture is an imaginary rope that binds people together, and an aid that reaches and realigns those who strayed

With employers required to be Super Stream compliant, a variety of Superannuation Clearing Houses are available to pay superannuation contributions fo

In our 12 March article, we advised that the Federal Government had announced a depreciation incentive to support business investment in response to C

The Federal and WA State Government have recently both announced grants totalling $45,000 to support the build of new homes or the renovation of exist

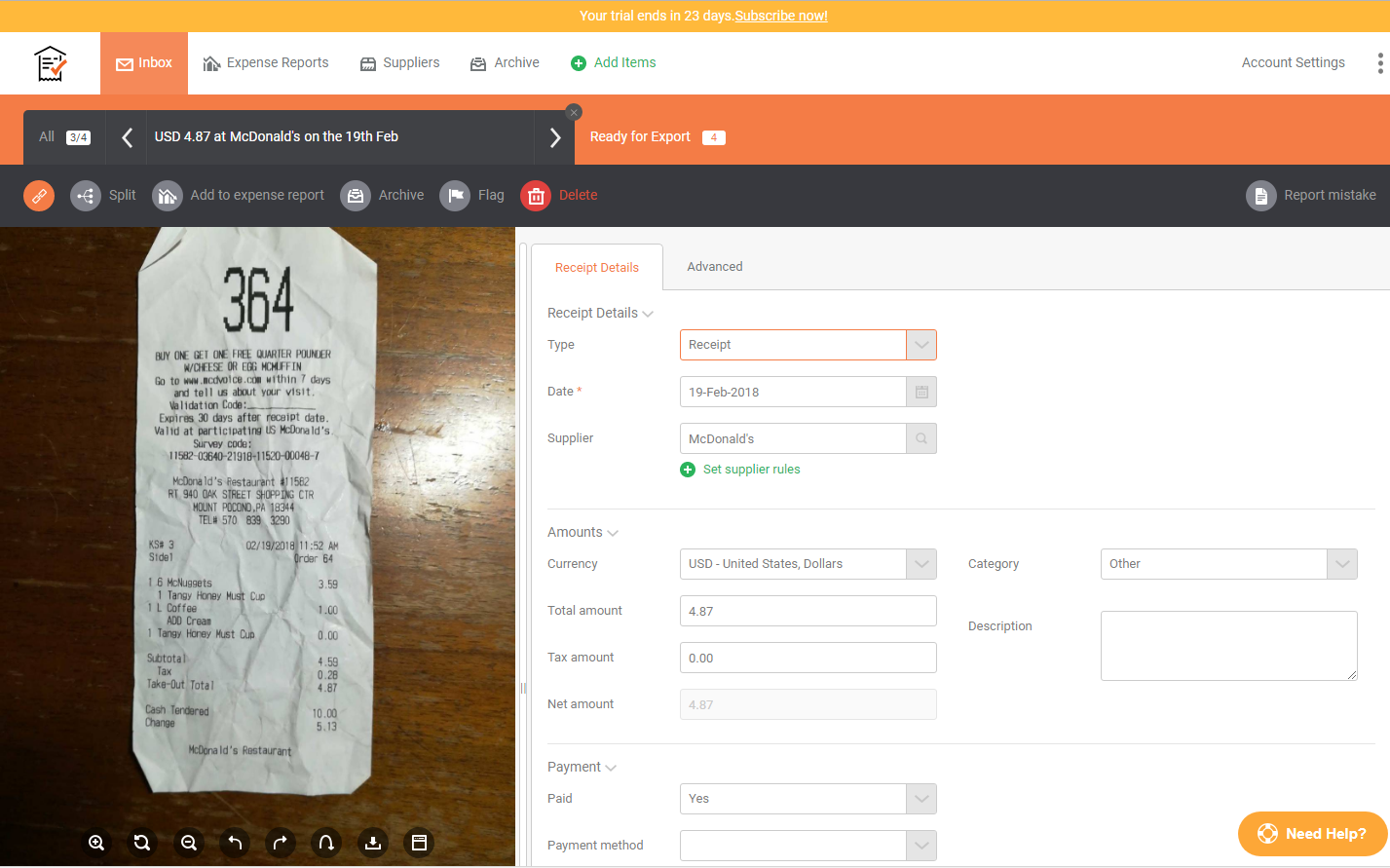

Receipt Bank helps create 'effortless bookkeeping' by extracting key information from your receipts and invoices, removing the need for manual dat

COVID-19 has impacted many Australian entities and many are finding it tough to stick to their reporting obligations especially due to remote work arr

The Australian Taxation Office ('ATO') has released the online application form today for employers, sole traders, and eligible business participa