Doing business in Australia

In the everchanging global economy, Australia provides immense opportunities for international business. The combination o

Latest Papers and Puplications

Data is driving the Fourth Industrial Revolution and we are being swamped by a deluge of data imperatives. How do we make sense of all this?

Listen to

We've created a quick reference guide for you containing the 2022-23 Tax rates. Covering both individual and company Tax rates, Tax offsets, superannuation, depreciation and fringe benefits Tax.

Budget update details for the 2022/2022 financial year.

Our full report is here.

Nothing could be further from the truth.

Many people in the crypto/NFT world have the mistaken belief that transactions involving crypto, NFT and bloc

The G20 asked the OECD to develop the Crypto-Asset Reporting Framework (CARF) for the automatic exchange of information on crypto-assets with the inte

Treasurer, Mr Josh Frydenberg, presented 2022-23 Federal Budget summary. Summarised are the main points of his budget.

The Federal Treasurer, Dr Jim Chalmers handed down the Labor government’s first Federal Budget at 7:30 pm (AEDT) on 25 October 2022.

We are busy scouring through 100's of pages preparing our report. We will update this page as soon as it is ready.

Please see our review of the budg

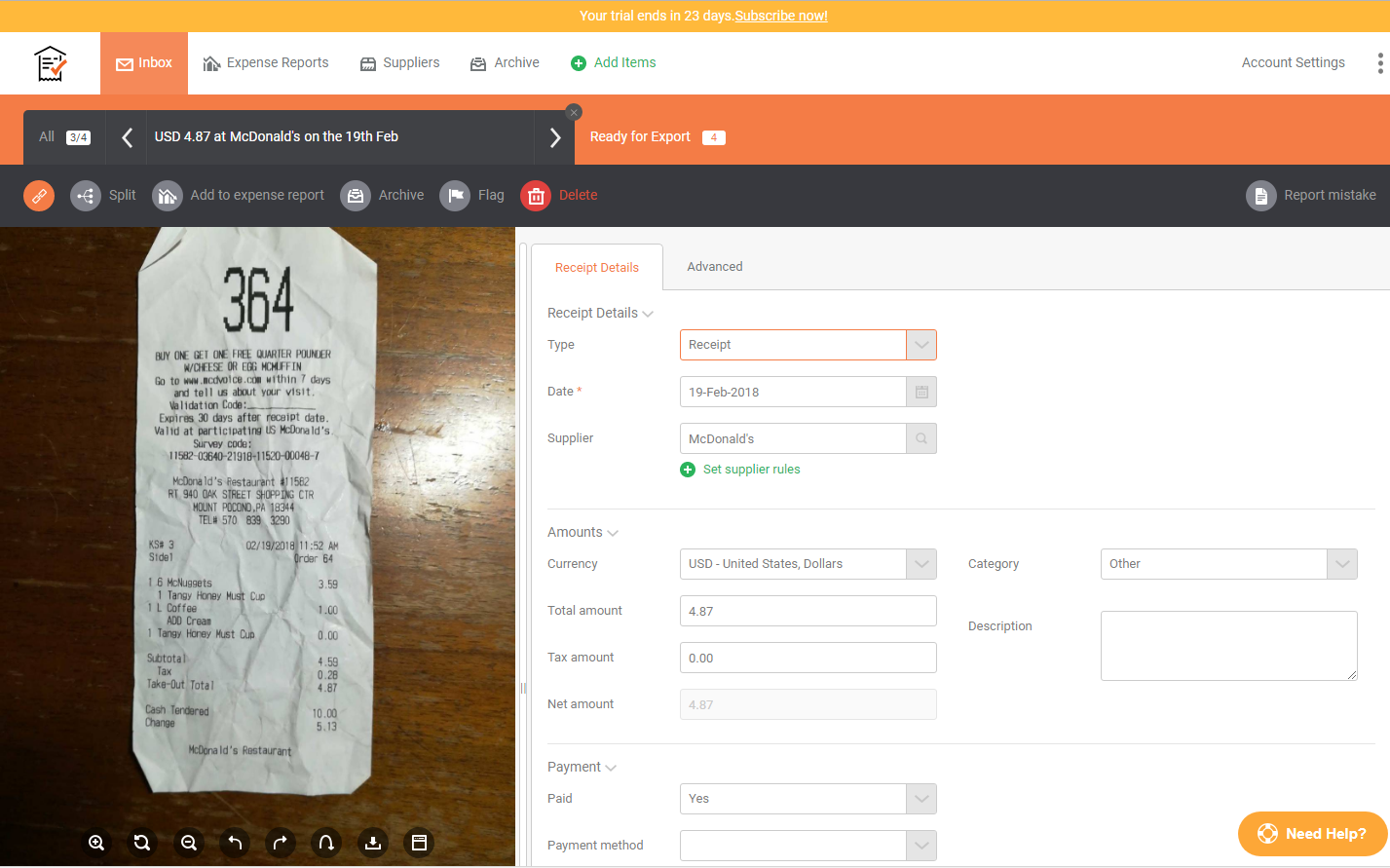

Receipt Bank helps create 'effortless bookkeeping' by extracting key information from your receipts and invoices, removing the need for manual dat