Thinner' Capitalisation - new earnings-based test from 1 July 2023

In the October 2022 Federal Budget, the Federal Government announced chang

Latest Papers and Puplications

Doing business in Australia

In the everchanging global economy, Australia provides immense opportunities for international business. The combination o

We've created a quick reference guide for you containing the 2022-23 Tax rates. Covering both individual and company Tax rates, Tax offsets, superannuation, depreciation and fringe benefits Tax.

Budget update details for the 2022/2022 financial year.

Our full report is here.

From Little Things - ESIC Tax OffsetAs the world changes, technology changes with it. Whether it's COVID forcing us to embrace remote working, the

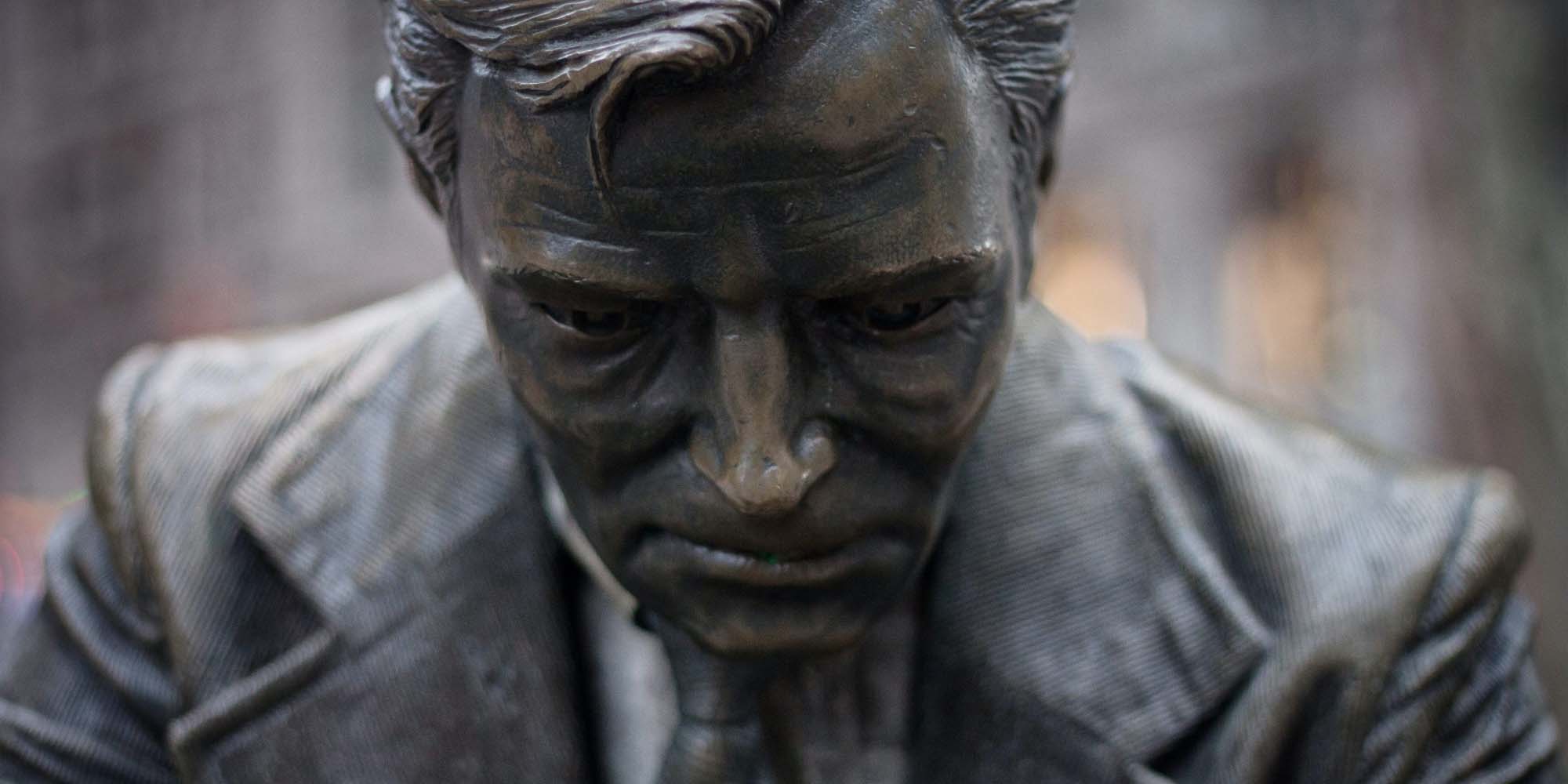

Treasurer, Mr Josh Frydenberg, presented 2022-23 Federal Budget summary. Summarised are the main points of his budget.

The Federal Treasurer, Dr Jim Chalmers handed down the Labor government’s first Federal Budget at 7:30 pm (AEDT) on 25 October 2022.

New legislation to enable corporate entities to utilise losses across prior year tax liabilities have received royal assent on the 14 October 2020 and has taken effect.

If you fail to plan, you are Planning to fail'

Another year, another June 30. A big day for business owners and accountants. To keep your end of

We live in a fast-changing world! Superannuation Income Streams....

The Federal Government has announced an extension of the temporary reduction in mi